The Open Insurance project is a SUSEP initiative that aims to allow policyholders from different institutions to share information securely. To design what Open Insurance would look like at Prudential required a strategic approach, from conception to execution, establishing a new standard in the interaction between consumers and insurance products.

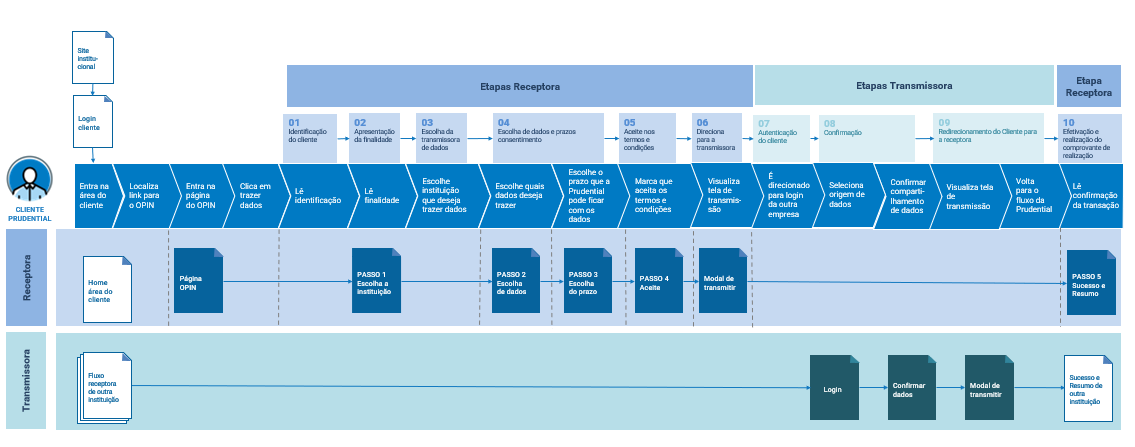

Definition of the Journey: We started with working groups in the institutions involved, aligning the SUSEP definitions and analyzing the available documentation. This deep understanding allowed the adaptation of a fluid journey, from the user's point of view, shaped from established guidelines and careful analysis of related documentation.

Comprehensive Prototyping: The transition to the prototyping phase was fundamental. Encompassing all phases of the project, from sharing to acceptance and administration, prototypes were developed based on an in-depth understanding of information flow and a comprehensive content inventory. This process ensured a faithful representation of the user journey.

Usability Tests: The next stage involved in-person and moderated usability testing, in which the prototypes were thoroughly evaluated on mobile devices. This approach allowed for a practical understanding of the user experience, identifying areas for improvement and refinement.

Adjustments and Delivery: Based on test insights, we make strategic adjustments to improve usability. The culminating moment was Delivery for the development team, marking the transition from theory to practice. The finalized and refined prototypes served as the foundation for effective implementation, highlighting the success of the team-led UX strategy.

The Open Insurance project not only represents a significant innovation in the sector, but also highlights the transformational capacity that a user-centric approach can offer in complex initiatives like this. This case is a testament to the synergy between strategic analysis, comprehensive prototyping and usability testing, resulting in successful delivery and an improved experience for insurance consumers.